The 2024 ANCHOR program is open now! See below if you are a Homeowner or Renter.

HOMEOWNERS

Homeowners who owned their main home on October 1, 2020 should have received their instructions in the mail in this envelope.

Tear off the sides of the envelope to open up your instructions.

The State Treasury Department Division of Taxation began mailing an “ANCHOR Benefit Confirmation Letter” on August 15, informing residents that the Division of Taxation will file their application if they received the ANCHOR benefit in a prior year. If everything has stayed the same, you do not need to do anything further.

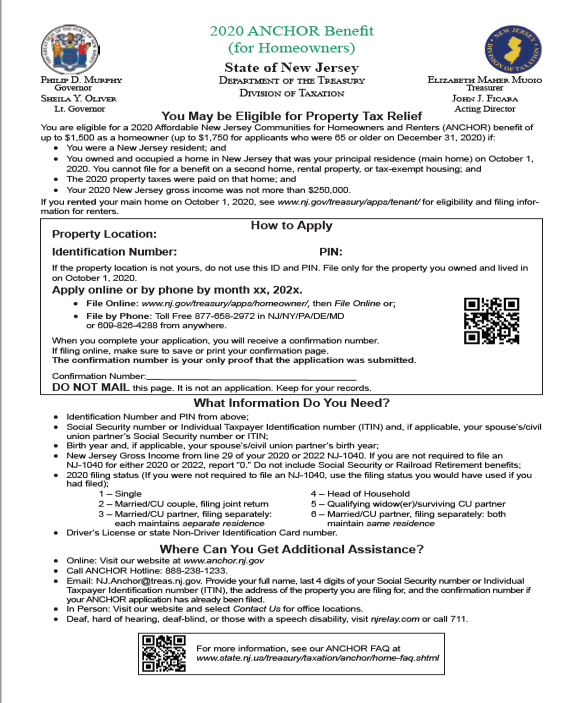

Some people who received an ANCHOR benefit last year may receive a green or purple filing packet in the mail instead of a confirmation letter. If you received one of these packets follow the instructions in the packet to apply for your benefit.

To change your information or apply for the first time, go to the ANCHOR website and click on the “File Online” box on the right, Remember, if you need to change your information, you must do so by September 30.

Go to the link below to visit the ANCHOR website.

You can also apply by phone by calling 877-658-2972 or submit via a paper application.

Lost your mailer or never received it?

The State Treasury Department Division of Taxation began mailing an “ANCHOR Benefit Confirmation Letter” on August 15, informing residents that the Division of Taxation will file their application if they received the ANCHOR benefit in a prior year.

If you did not receive a confirmation letter or filing packet, but meet the qualifications for the benefit based on 2020 residency, income, and age, you may still apply for the program:

Homeowners. Most homeowners may file online or by phone with an identification number (ID) and PIN. However, if you bought your home in 2020, altered your deed, or had certain life changes such as a divorce or death of a spouse, you must file an application by mail.

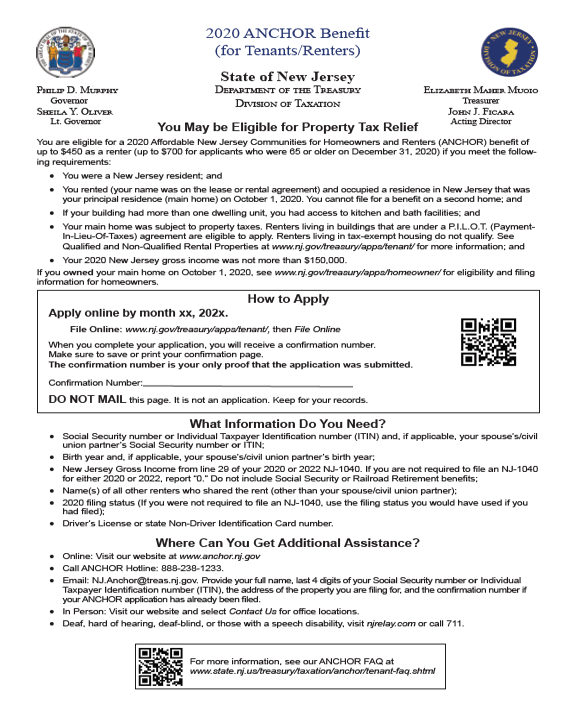

Renters may file using the online option, and do not need an ID and PIN.

If this is your first time applying for ANCHOR, your application deadline is December 29, 2023.

RENTERS

Renters who rented their main home on October 1, 2020 should have received their instructions in the mail in this envelope.

Tear off the sides of the envelope to open up your instructions.

The State Treasury Department Division of Taxation began mailing an “ANCHOR Benefit Confirmation Letter” on August 15, informing residents that the Division of Taxation will file their application if they received the ANCHOR benefit in a prior year. If everything has stayed the same, you do not need to do anything further.

Some people who received an ANCHOR benefit last year may receive a green or purple filing packet in the mail instead of a confirmation letter. If you received one of these packets follow the instructions in the packet to apply for your benefit.

To change your information or apply for the first time, go to the ANCHOR website and click on the “File Online” box on the right, Remember, if you need to change your information, you must do so by September 30.

Go to the link below to visit the ANCHOR website.

You can also apply by phone by calling 877-658-2972